Protecting an Equity Loan: Actions and Requirements Described

Protecting an Equity Loan: Actions and Requirements Described

Blog Article

Maximize Your Possessions With a Strategic Home Equity Finance Strategy

In the world of monetary management, one usually seeks methods to optimize properties and make critical decisions that yield long-term benefits. One such avenue that has amassed focus is the use of home equity through a thoughtfully crafted car loan strategy. By taking advantage of the equity developed within your home, a variety of possibilities emerge, supplying a possible increase to your monetary profile. The crucial lies not simply in accessing these funds yet in devising a tactical strategy that maximizes their capacity. As we navigate the complex landscape of home equity fundings, the importance of careful preparation and foresight comes to be increasingly evident.

Understanding Home Equity Loans

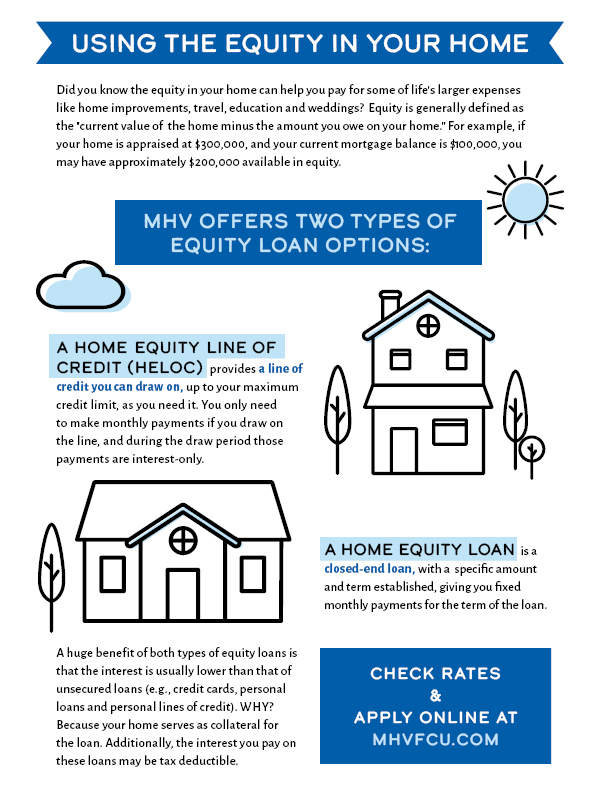

An extensive grasp of the ins and outs surrounding home equity loans is essential for informed financial decision-making. Home equity loans enable property owners to utilize the equity accumulated in their home to accessibility funds for numerous purposes. One vital facet to recognize is that these financings are secured by the worth of the home itself, making them less dangerous for lenders and often leading to lower rates of interest for debtors compared to unsafe financings.

Moreover, understanding the loan-to-value proportion, repayment terms, potential tax obligation implications, and the risks associated with using your home as collateral are vital parts of making audio economic choices relating to home equity car loans. By getting a complete understanding of these aspects, homeowners can use home equity lendings purposefully to accomplish their monetary goals.

Advantages of Leveraging Home Equity

Utilizing the equity in your house can supply a variety of monetary benefits when strategically leveraged. One of the main benefits of leveraging home equity is accessibility to huge amounts of cash at relatively reduced rates of interest compared to other kinds of loaning. By utilizing your home as security, lenders are extra happy to use beneficial terms, making home equity lendings an attractive alternative for financing significant expenses such as home remodellings, education expenses, or debt consolidation

Moreover, the passion paid on home equity car loans is often tax-deductible, providing prospective financial savings for homeowners. This tax obligation benefit can make leveraging home equity a lot more economical compared to other sorts of loans. Additionally, home equity fundings typically offer longer settlement terms than personal finances or charge card, permitting even more convenient regular monthly repayments.

Moreover, by reinvesting borrowed funds right into home improvements, home owners can potentially enhance the value of their residential property. This can lead to a greater resale value or boosted living problems, better boosting the economic advantages of leveraging home equity. On the whole, leveraging home equity intelligently can be a critical financial step with numerous benefits for home owners.

Strategic Preparation for Car Loan Utilization

Having developed the advantages of leveraging home equity, the following essential action is tactically planning for the use of the loan profits - Home Equity Loan. When considering how to finest utilize the funds from a home equity financing, it is necessary to have a clear strategy in area to optimize the advantages and guarantee financial stability

One strategic technique is to utilize the financing proceeds for home renovations that will raise the residential property's value. Restorations such as kitchen area upgrades, bathroom remodels, or including added home can not only boost your daily living experience yet additionally improve the resale value of your home.

An additional sensible use home equity funding funds is to settle high-interest financial debt. By paying off credit rating cards, individual fundings, or other financial obligations with reduced rate of interest proceeds from a home equity lending, you can save cash on interest payments and simplify your funds.

Lastly, spending in education and learning or moneying a significant cost like a wedding celebration or medical expenses can additionally be tactical uses home equity financing funds. By carefully planning how to allot the profits, you can leverage your home equity to attain your economic objectives successfully.

Dangers and Factors To Consider to Bear in mind

Taking into consideration the prospective pitfalls and aspects to think about is important when contemplating the use of a home equity finance. One of the key risks associated with a home equity funding is the opportunity of defaulting on settlements. Since the financing is secured by your home, failing to pay off might cause the loss of your residential property with foreclosure. It's important to analyze your monetary stability and ensure that you can pleasantly handle the added financial debt.

An additional factor to consider is the changing nature of rates of interest (Home Equity Loan) (Alpine Credits copyright). Home equity fundings frequently come with variable passion prices, implying your regular monthly payments can boost if interest prices climb. This possible rise must be factored right into your monetary preparation to avoid any type of surprises down the line

Additionally, be careful of overborrowing. While it may be alluring to access a huge sum of money with a home equity financing, only borrow what you absolutely require and can afford to settle. Cautious consideration and prudent monetary management are crucial to successfully leveraging a home equity financing without coming under economic troubles.

Tips for Successful Home Equity Lending Monitoring

When navigating the realm of home equity financings, sensible economic monitoring is crucial for optimizing the advantages and lessening the associated risks. To efficiently handle a home equity funding, start by producing an in-depth spending plan that outlines your month-to-month income, expenditures, and loan payment commitments. It is important to focus on timely repayments to avoid charges and maintain an excellent credit rating.

Consistently monitoring your home's worth and the equity you have actually constructed can help you make informed decisions about leveraging your equity even more or readjusting your payment strategy - Equity Loan. Furthermore, think about establishing up automated settlements to make sure that you never ever miss a due day, hence safeguarding your economic standing

One more idea for effective home equity funding administration is to explore chances for re-financing if rates of interest drop dramatically or if your credit report boosts. Refinancing could potentially reduce your month-to-month payments or enable you to settle the funding much faster, saving you money over time. By adhering to these approaches and remaining aggressive in your economic preparation, you can successfully right here manage your home equity funding and make the most of this valuable financial device.

Final Thought

In verdict, strategic preparation is necessary when using a home equity financing to maximize assets. Understanding the dangers and advantages, along with carefully thinking about just how the funds will certainly be used, can aid guarantee effective monitoring of the lending. By leveraging home equity intelligently, individuals can take advantage of their assets and achieve their economic objectives.

Home equity financings enable home owners to leverage the equity built up in their home to gain access to funds for various purposes. By utilizing your home as security, loan providers are extra willing to provide positive terms, making home equity financings an attractive option for funding significant expenditures such as home restorations, education and learning expenses, or debt loan consolidation.

In addition, home equity financings commonly provide longer repayment terms than personal finances or credit score cards, enabling for even more convenient monthly repayments.

Cautious factor to consider and sensible economic monitoring are key to effectively leveraging a home equity lending without dropping into economic difficulties.

To successfully manage a home equity financing, beginning by producing a detailed budget that describes your month-to-month income, costs, and loan payment responsibilities.

Report this page